Higher Private Sector Deposits: 63% Savings and 37% Running Accounts

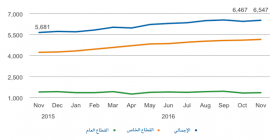

The value of private sector deposits (running accounts, savings and time deposits) in the banks operating in Palestine with the end of November 2016 reached about 9788 billion US dollars, compared with about 9.030 billion dollars in the same month of 2015, with an increase of 8.4%.

Current accounts accounted for approximately 37% of total deposits, while total deposits in savings accounts and time deposits reached approximately 63% increasing by 10.6% compared with the same month of 2015.

It is clear from the previous data, the citizens went to save their money in banks and refrained from investing as a result of several factors, including: fear of the future because of the continuing deterioration of economic conditions, the deadlock in the political process, the state of division, Israeli obstacles and other reasons, such as high interest rates on loans compared with the neighboring countries, which reduces individuals, companies and foreigners’ desire to invest in Palestine.

The deterioration of the situation reflected on the running accounts, which only increased by 4.8% in the same month. The economist Nasr Abdul Karim said that the increase in the running accounts did not come primarily from increasing the income of citizens but of credit facilities from banks "When borrowing, banks put that money in your account, a so-called derivative deposits."

According to data from the Monetary Authority, net credit facilities rose 15.2% during November compared with the corresponding period of 2015.

In his turn, financial expert Mohammed Salameh agreed with Abdul Karim that the basis of the rise in the running accounts is due to increased credit facilities. On the high demand for savings account, he said it is due to the temptation policy of banks through the awards while increasing the interest rate on bank time deposits account increases citizens and investors’ appetite for that account.

It seems that the current year will see an increase in demand on savings and time deposits. In light of the deteriorating situation and the accompanying bank temptations to increase profits, investors prefer to put their money in the banks to achieve certain gains, while others will go to savings account to save their money and secure the future of their children.