The Monthly PMA Business Cycle Index (PMABCI) – October 2016

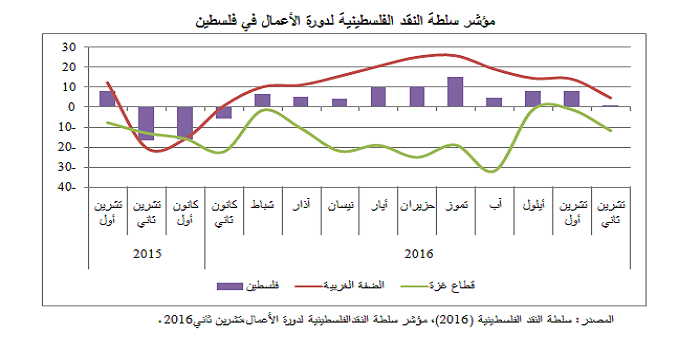

The PMA has released the results of its Business Cycle Index (PMABCI) for October 2016. The results revealed a slight decline in Palestine's overall index, due substantially to the decline in the West Bank's index, and much less in Gaza Strip's index. As a result, the overall index decline from 8.3 points in September to around 8.1 points during October. Nevertheless, the index achieved a higher level than achieved in October 2015, (8.0 points).

In the WB, the index continued to decline, reaching its lowest level in seven months (14.0 points), compared to 14.3 points in the previous month. This came as most of the industrial activities’ indices declined, particularly that for the food sub-sector (from 6.8 points to 5.4 points), for textiles sub-sector (from 4.5 points to 3.4 points), for the furniture sub-sector (from 2.8 points to 1.2 points), and for the engineering and precious metals sub-sector (from 0.8 points to 0.3 points). Conversely, indices of leather, paper, and plastic sub-sectors have slightly increased, while the (traditional) wood industry index remained the same.

Moreover, data revealed a lower optimism about the near future among industrial firms' owners, which was considered the main reason behind the drop in the WB index. Firms' owners expressed concerns regarding future production and employment.

In GS, the index declined slightly from -1.2 points in last September to around -1.3 points during this month, due to the decline in the plastic sub-sector's index, while the remaining sub-sectors remained stable. Nevertheless, the highly volatile Gazan index has remarkably improved compared to October 2015, but it stayed locked in the negative area for more than three consecutive years (except for June 2015). However, Moreover, forecasts of production and employment in the near future also stayed unchanged also.

The performance of the Gaza's index doesn't belittle the adverse effects of the severe obstacles which continued to undermine economic activity in GS, particularly in the industrial sector. Those obstacles include the continued Israeli siege, closure of the Rafah border crossing, and prolonged delays in reconstruction efforts, in addition to the long-standing fuel and electricity crisis that remains without a radical solution.

I It is also noteworthy that the PMABCI is a monthly index, which aims to capture the state and evolution of economic activity in Palestine by tracking the performance of the industrial sector, especially fluctuations in production and employment levels and their implications for the economy at large. The maximum value of the PMABCI is positive 100 point, while the minimum is minus 100 point; a positive value indicates favorable economic performance, while a negative value indicates bad performance. On the other hand, a value close to zero indicates that economic performance did not change and is unlikely to do so in the near future.